For many mid-market companies, the year-end financial close feels like crossing a finish line.

- The numbers reconcile.

- The reports are delivered.

- The board is briefed.

Closure feels earned.

But for CFOs, Controllers, and VPs of Finance, the financial close process is not the finish line.

It is the starting block for the next one.

The annual close is the only moment when the full financial architecture of the business is visible at once: margin durability, cash conversion, cost discipline, and working capital intensity.

For organizations in the $100M–$1B range, visibility is not administrative.

It is strategic leverage.

Most teams confirm accuracy.

Disciplined finance leaders extract direction.

In 2026, that distinction will determine who secures resources and who defends budgets.

What the Financial Close Actually Enables

The close does more than confirm performance.

It provides the clean baseline required for strategic recalibration and disciplined financial planning and forecasting.

For finance leaders, three questions should define the post-close review, a strategic financial close checklist for moving from reporting to positioning.

1. Was Growth Durable or Deferred?

Year-end data clarifies whether:

- Margin expansion was structural or cost-deferral driven

- Revenue converted to cash efficiently

- Scale reduced complexity or increased it

This is the strategic post-mortem.

Without this separation, 2026 financial forecasting risks inheriting 2025’s distortions.

2. Are Forecast Assumptions Still Valid?

Clean, reconciled data is the only reliable foundation for forward modeling.

The close should trigger:

- Resetting margin assumptions

- Updating working capital projections

- Stress-testing cost structure

- Recalibrating revenue pacing

Forward plans built on stale assumptions undermine capital discipline and weaken long-term financial planning strategies.

The close is where those assumptions are corrected.

3. Can You Articulate Financial Health Clearly?

The annual close is also narrative preparation.

Boards and investors do not fund ambition.

They fund clarity.

Finance must now translate:

- Margin durability

- Cash runway

- Risk exposure

- Capital efficiency

into a coherent strategic narrative that justifies 2026 investment priorities.

This is where finance shifts from reporting to influence.

The 2026 Shift: From Reporting Accuracy to Capital Positioning

The next fiscal cycle will not reward activity.

It will reward disciplined allocation.

That shift reflects a broader reality:

- Capital is tighter.

- Scrutiny is higher.

- Precision is expected.

What 2026 Will Not Reward:

- Expansion without margin durability

- Financial forecasting is unsupported by clean baseline data

- Capital deployment without scenario modeling

- Delayed visibility into cash risk

What 2026 Will Reward:

- Margin intelligence

- Forecast discipline

- Scenario readiness

- Real-time financial visibility

This is not simply a reporting evolution.

It is a positioning recalibration.

Finance now shapes capital posture, investment sequencing, and risk tolerance, before strategy moves forward.

Leveraging the Close: A Strategic Post-Mortem Checklist

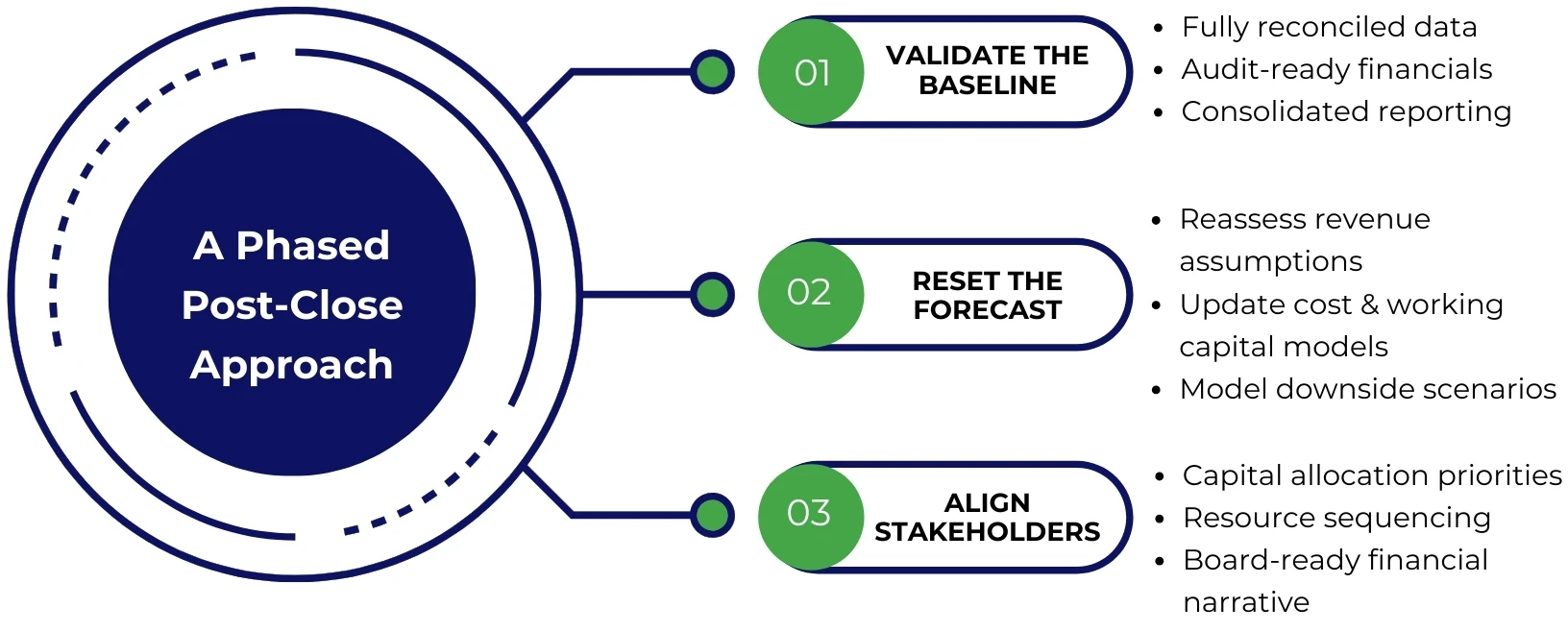

The close should trigger action in a deliberate sequence.

For CFOs and Controllers, disciplined financial close management extends beyond reconciliation. It becomes the foundation for forward positioning.

Phase I: Validate the Baseline

Ensure financial data is:

- Fully reconciled

- Audit-ready

- Free of manual distortion

- Consolidated across entities

This is foundational.

Without clean data, forecasting remains speculative.

Premier NX Finance & Accounting Outsourcing (FAO) teams specialize in compressing close cycles and delivering audit-ready financials quickly, enabling leadership to move from reconciliation to strategy without delay.

Phase II: Rebuild the Forecast with Clean Data

Once the baseline is validated:

- Reassess revenue assumptions

- Update cost models

- Recalculate working capital cycles

- Model downside and volatility scenarios

Premier’s Analytics and FP&A capabilities extend beyond reporting, translating clean financial data into forward-looking financial models that support disciplined 2026 planning.

Phase III: Communicate with Strategic Clarity

Finally, finance must align stakeholders.

That means converting financial outputs into:

- Capital allocation recommendations

- Resource prioritization frameworks

- Scenario-backed investment cases

- Board-ready financial narratives

Data alone does not secure approval.

Clarity does.

Premier NX bridges this final step by integrating financial reporting with analytical insight, helping mid-market leadership teams present not just results, but positioning.

Why This Matters for the Mid-Market

Companies in the “Muddy Middle” face enterprise-level expectations without the finance infrastructure to support them.

Close cycles strain lean teams.

Forecasting competes with daily transaction volume.

Strategic modeling gets delayed.

The result is hesitation at the very moment precision is required.

Premier NX was built specifically for this inflection point.

Our FAO teams stabilize the transactional foundation.

Our analytics pillar elevates the strategic layer.

Together, they transform the annual close from a compliance exercise into a strategic catalyst.

The Close Is Done. The Next Race Has Started.

For December- and January-fiscal-year companies, the books are closed.

Now comes the disciplined work:

- Revalidate assumptions

- Rebuild forecasts

- Reposition capital

- Align stakeholders

The 2026 advantage will not belong to those who closed cleanly.

It will belong to those who leveraged the close decisively and embedded stronger financial optimization strategies into their planning cycle.

If your post-close review reveals structural gaps, now is the time to reinforce them.