You didn't outsource finance & accounting to manage fragmented workflows.

You did it to gain control—to stabilize core operations, streamline execution, and free your team to focus on strategic priorities. But if your FP&A tools still sit outside that system, manually fed, loosely connected, or entirely siloed—you're limiting their impact.

Integration isn't a technical afterthought. It's the strategic inflection point.

The value of FP&A tools lies not just in their features, but in their ability to connect: actuals to forecasts, payables to cash flow, workforce data to planning models.

When your planning tools are fully embedded into your long-term Finance & Accounting Outsourcing strategy, they stop producing static reports—and start powering real-time decisions.

Strategic Finance Demands Connected Systems—Not Just Closed Books

Today, financial accuracy is a table stake. What sets modern finance apart is the ability to act on live data before the books are closed.

That level of agility demands more than clean reconciliations. It requires synchronized systems where data flows continuously across accounts payable, receivables, payroll, and revenue operations. When these sources remain fragmented, finance becomes reactive, anchored to historical reports that arrive too late to influence outcomes.

Integration closes that gap. It aligns execution with insight. It links actual planning, transactions to forecasts, and financial processes to business strategy.

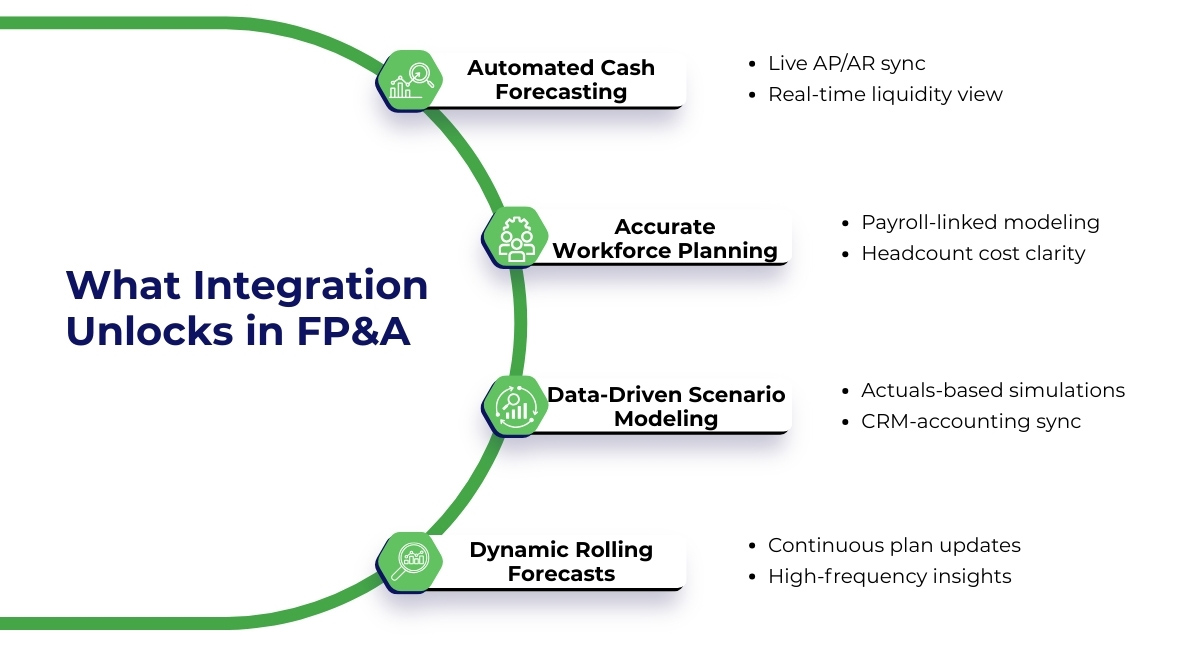

What Happens When FP&A Tools Are Truly Integrated

- Automated Cash Forecasting: Updates in real-time based on AP and AR movement, providing clear visibility into liquidity and operational runway.

- Accurate Workforce Planning: Reflects live payroll data, enabling precise modeling of headcount costs and hiring scenarios without manual rework.

- Data-Driven Scenario Modeling: Planning tools pull directly from accounting and CRM systems to simulate realistic growth or cost-containment strategies.

- Dynamic Rolling Forecasts: Adapt continuously, replacing static annual plans with flexible, high-frequency financial insight.

Why Mid-Market Companies Struggle to Make This Work

Mid-market firms face unique hurdles on the path to a unified finance function. The core challenges include:

Lean IT and Finance Operations

Most lack dedicated integration teams, leaving staff focused on transactions, not connectivity.

Budget Constraints

Incremental tool adoption leads to a fragmented best-of-breed stack without unified data.

Tools Deployed Tactically, not Strategically

FP&A software is often introduced to solve reporting pain points—not as part of an integrated finance architecture.

Competing Priorities in Growth Environments

Near-term execution pressures, risk management, and cash flow optimization often take precedence over long-term tool integration.

The Long-Term Strategy: A Unified Finance Ecosystem

The true value of Finance and Accounting Outsourcing lies not only in operational efficiency, but in enabling a finance function that is agile, connected, and insight-driven.

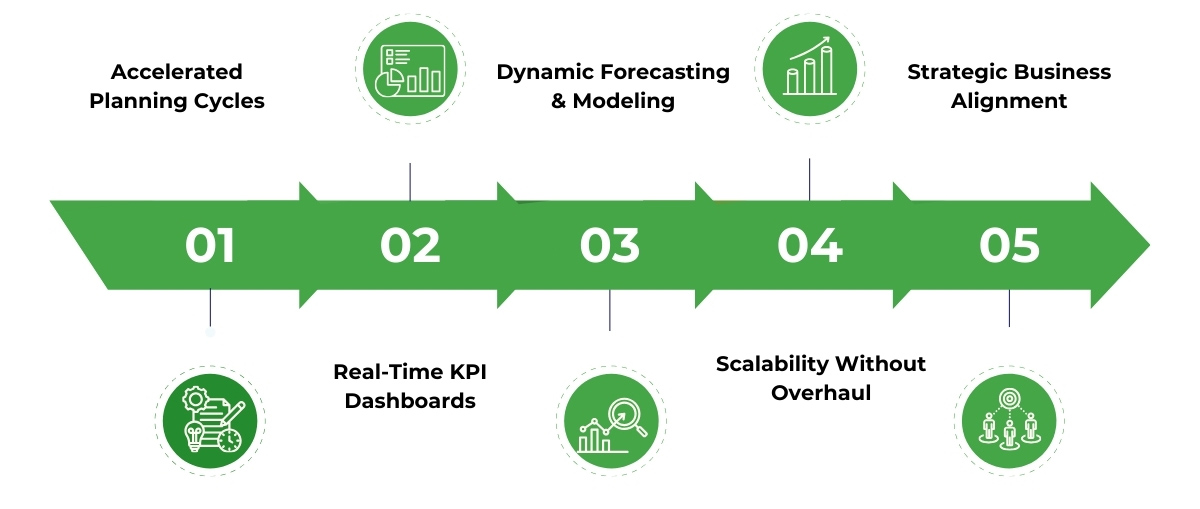

A fully integrated finance and accounting outsourcing strategy unlocks:

- Accelerated Planning Cycles: Driven by real-time data inputs across AP, AR, payroll, and revenue.

- Real-Time KPI Dashboards: Giving leadership immediate visibility into financial performance without waiting for the month-end close.

- Dynamic Forecasting & Modeling: Tied directly to transactional systems and operational data.

- Scalability Without Overhaul: Growing complexity without rebuilding your finance architecture.

- Strategic Business Alignment: Making planning a connected capability, not an isolated function.

How Premier NX Delivers Integration-First FP&A

For many mid-market firms, the barrier to strategic finance isn't tool selection—it's integration. FP&A platforms are often in place but disconnected from the day-to-day financial operations they're meant to support.

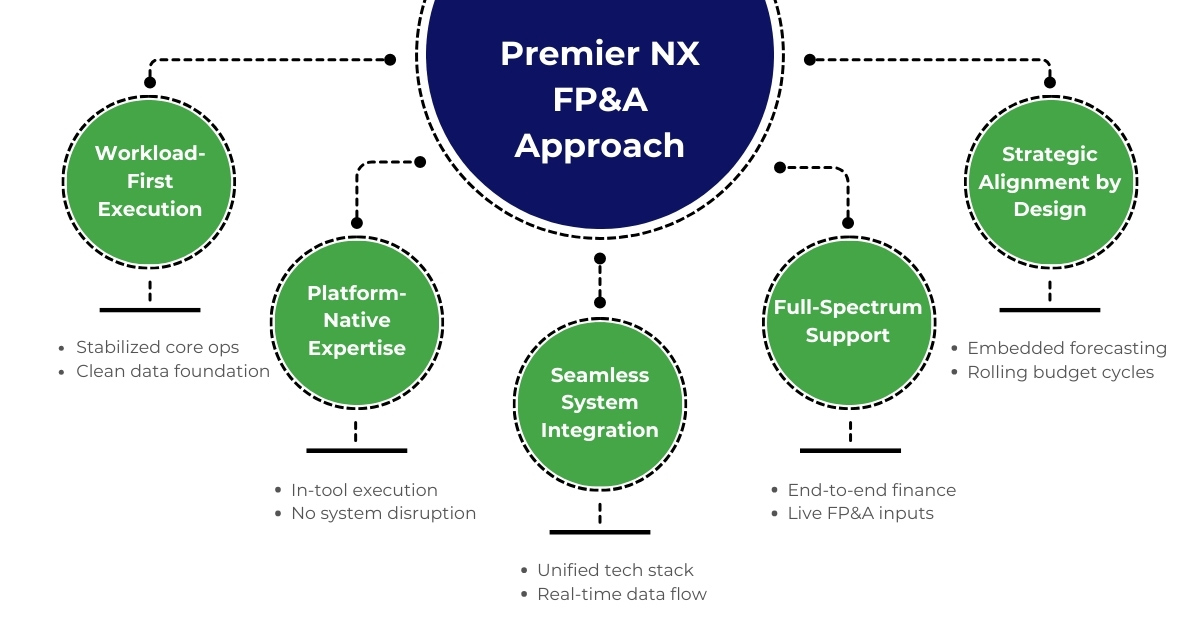

Our approach ensures tools become strategic assets, not isolated overhead:

- Workload-First Execution

We stabilize core functions—AP, AR, payroll, reconciliations—ensuring clean data and operational clarity before layering in technology. - Platform-Native Expertise

We work directly within your existing stack (QuickBooks, Sage Intacct, NetSuite, etc.) to maximize your current investments. - Seamless System Integration

We connect CRMs, ERPs, HR platforms, and planning tools into a unified, data-flowing ecosystem. - Full-Spectrum Support

We manage the function end-to-end, from transactions to reporting, ensuring your planning tools operate on live, reliable data. - Strategic Alignment by Design

Integration is baked into our delivery model, supporting real-time forecasting and rolling budgets as part of daily operations.

Turn Tools into Strategy, Not Overhead

Premier NX helps mid-market leaders transform Finance and Accounting Outsourcing from operational lift into a unified, insight-ready ecosystem. By embedding FP&A tools within your finance delivery model, we enable faster planning, sharper forecasting, and better decisions.

Ready to move from static reporting to dynamic insight? Explore how our integration-first approach to finance and accounting outsourcing can transform your FP&A process.