For the mid-market CFO, the growth path is often blocked by a familiar obstacle: the gap between current capacity and future ambition. Your team is capable, but buried in transactions. You know something must change, yet misconceptions about finance and accounting outsourcing (FAO) can cloud your judgment.

What if these perceived risks were actually the gateway to greater control, sharper accuracy, and a more strategic finance function?

84% of CFOs report significant talent shortages in finance and accounting — making strategic outsourcing a necessity, not a trend.1

It's time to replace outdated assumptions with a clearer, more strategic view. Let's examine the five most common myths holding finance leaders back—and the realities that can empower your next decision.

This piece offers a clear-eyed look at five of the most common myths—and the modern realities finance leaders must consider when evaluating their next move.

The Myth vs. The Reality

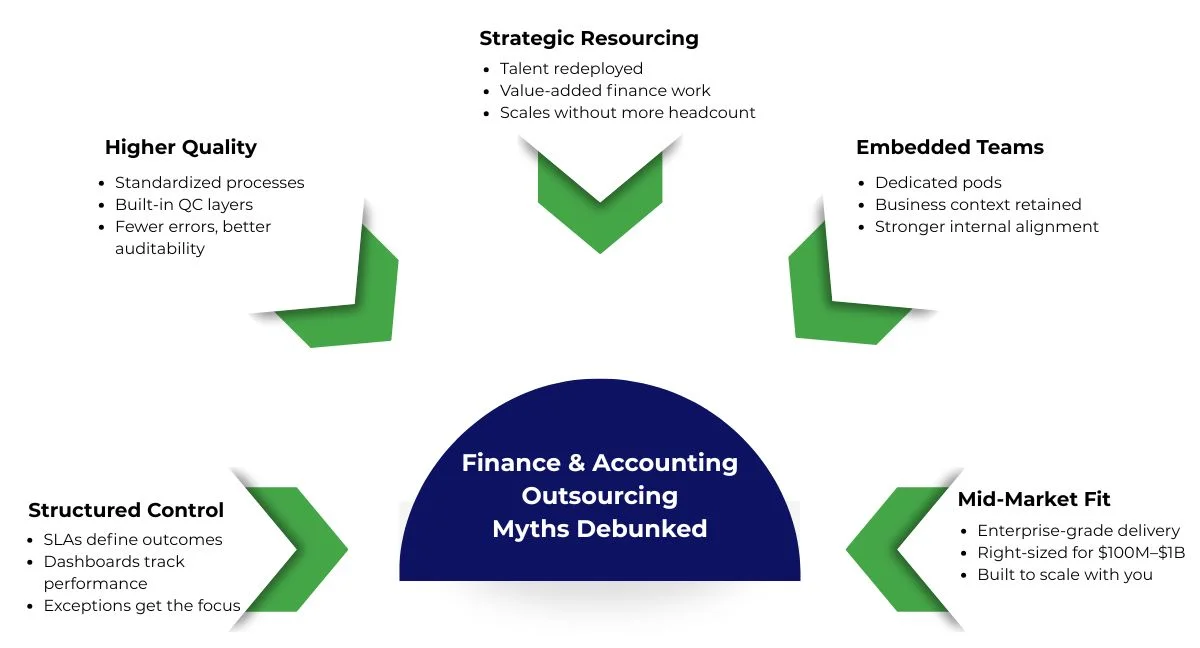

Myth 1: We'll lose control over our finances.

Reality: You exchange hands-on management for performance-based governance.

The fear of relinquishing oversight is understandable, but modern FAO replaces ad-hoc oversight with disciplined, data-driven control. Through defined service-level agreements (SLAs), real-time performance dashboards, and audit-ready documentation, you gain a more transparent view of your operations than many overstretched internal teams can provide.

This allows you to practice management by exception, focusing your valuable time on strategic analysis and outlier management, not routine transaction monitoring.

Myth 2: The quality and accuracy will suffer.

Reality: Specialization and standardized processes elevate quality.

Quality suffers under strain, not under specialization. A dedicated partner operates on a foundation of standardized procedures, segregated duties, and integrated quality checks. Every transaction is subject to verification and reconciliation, with performance metrics like error rates and cycle times continuously monitored.

For mid-market firms operating with lean teams, this structured environment often delivers a higher degree of accuracy and auditability than the overburdened, hero-based culture it replaces.

Myth 3: It's only about cost-cutting and will lead to layoffs.

Reality: It's a strategic resourcing model that reallocates talent to growth.

The true value of outsourcing isn't in reducing headcount, but in radically reallocating it. By transferring transactional workload to a partner, you preserve your most experienced and expensive in-house talent for high-value work: FP&A, M&A support, and business partnership.

This model isn't about doing less; it's about achieving more. It allows your finance function to scale its strategic impact without linearly increasing its size and cost.

Myth 4: It's too impersonal; we'll lose the human touch.

Reality: A dedicated team model deepens stakeholder connection.

The legacy model of impersonal call centers doesn't apply to modern finance co-sourcing. The right partner embeds a dedicated team that learns your business rhythms, communication preferences, and strategic context.

This creates a level of continuity and focus that can be difficult to maintain internally amidst staff turnover and shifting priorities.

The result is a more consistent, reliable, and context-aware partnership for your internal stakeholders.

Myth 5: It's only for large corporations.

Reality: It is the mid-market's access point to enterprise-grade capability.

Today's FAO models are specifically designed for the "muddy middle." They deliver the control, expertise, and technology enablement of an enterprise solution, but are structured with the agility and affordability the mid-market requires.

This allows companies with $100M–$1B in revenue to operate with a level of financial discipline and strategic insight that was previously out of reach, turning the finance function from a cost center into a competitive advantage.

Informed Decisions Are Better Decisions

The decision to explore outsourcing is not an admission of failure; it is a commitment to elevating the finance function's role. By moving beyond these myths, CFOs can see FAO for what it is: a strategic lever to gain control, enhance quality, and refocus their best people on shaping the future.

Premier NX – A Strategic Partner for Mid-Market Finance & Accounting Outsourcing

At Premier NX, we guide mid-market leaders through this exact transition. Our approach is built to address these concerns directly:

- We establish clear governance and transparency from day one, giving you more control, not less.

- We bring standardized processes and expert oversight to ensure superior quality and accuracy.

- Our co-sourcing model is designed to augment your team, freeing them to drive growth.

- We provide a dedicated team, a small group of our experts assigned exclusively to you, functioning as a seamless extension of your finance department.

We don't just take on tasks; we provide a foundational framework that enables your evolution from steward to architect.

Is your finance function structured to support the strategic CFO you need to be? Reach out for a confidential conversation and let us help you build the case for a strategic approach to finance and accounting.