Outsourcing accounting simplifies finance for small businesses, reducing costs, improving accuracy, and freeing leadership to focus on growth.

For small business owners, founders, and operations leaders, accounting is often a hidden tax on time. Between managing books, chasing receipts, handling payroll, and preparing for tax season, valuable hours are consumed by financial busywork.

This guide is designed for decision-makers ready to elevate their finance function without adding headcount. It explores what outsourced accounting entails, which tasks can be delegated (from bookkeeping to virtual CFO services), and how to mitigate common risks.

You’ll learn about cost structures, tech tools like QuickBooks Online and Xero, and how to evaluate providers, from bookkeepers to controller-level support.

What are Outsourcing Accounting Services for Small Business?

Outsourcing accounting services is the use of an external accounting provider to manage bookkeeping, reporting, and financial oversight without hiring in-house staff.

It means engaging a specialized firm or professional to handle defined accounting functions, partially or end-to-end, under an agreed scope, cadence, and control framework. The goal is not delegation alone, but establishing a reliable finance operating model aligned with the business stage and complexity.

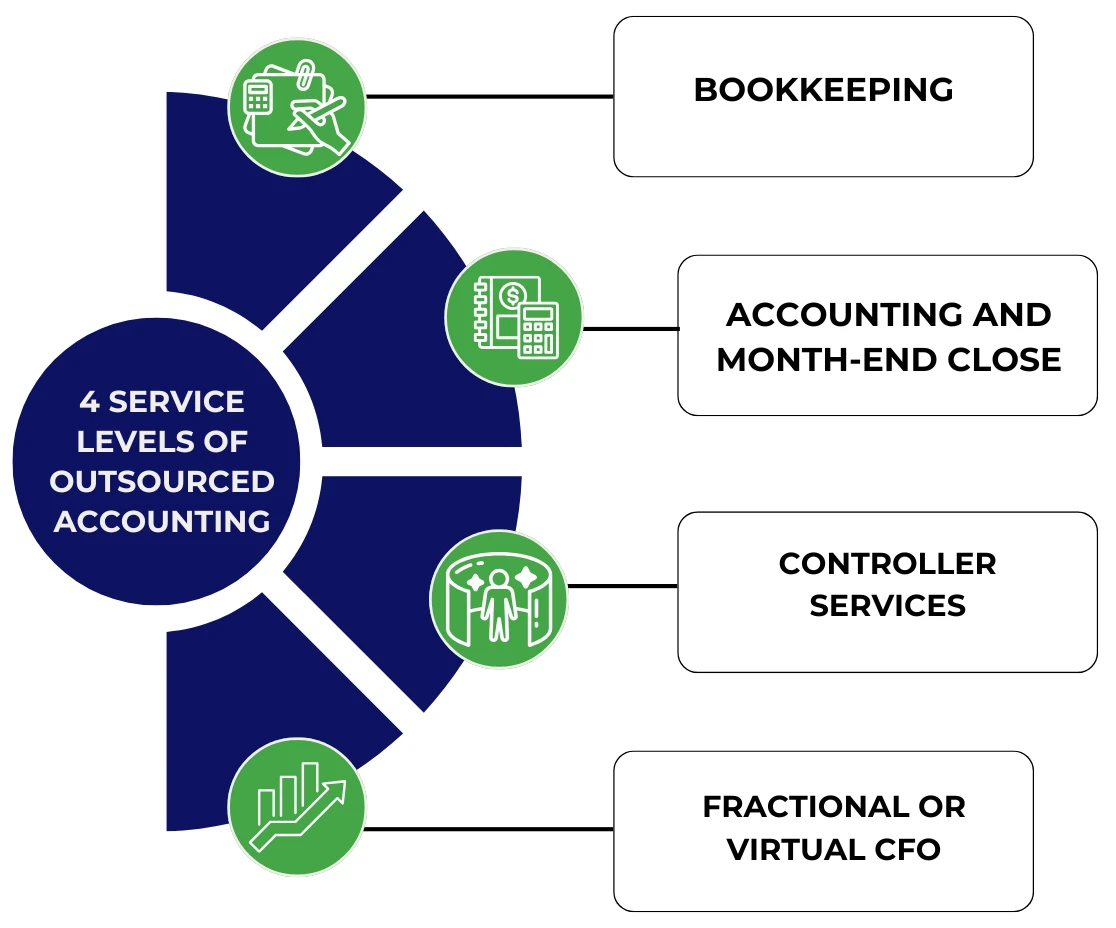

Outsourced accounting typically spans four service levels:

1. Bookkeeping:

Day-to-day transaction recording, categorization, and bank or credit card reconciliations. This layer ensures the chart of accounts remains clean and supports accurate reporting in systems such as QuickBooks Online or Xero.

2. Accounting and month-end close:

Accruals, adjusting entries, and structured month-end close processes that produce reliable financial statements, including P&L (income statement), balance sheet, and cash flow statement.

3. Controller services:

Independent review of reconciliations and journal entries, close management, internal controls, and accounting policy decisions aligned with GAAP or IFRS.

4. Fractional or virtual CFO:

Forward-looking finance leadership focused on forecasting, budgeting, KPI design, margin analysis, and decision support.

What to expect on a monthly basis:

A defined close calendar, reconciled accounts, finalized financial statements, documented assumptions, and review-ready books that support coordination with your CPA or EA (Enrolled Agent).

In practice, outsourcing replaces fragmented, ad hoc accounting with a structured finance function scaled to the needs of the small business owner, founder, or operations manager.

Why do Companies Outsource Accounting?

Businesses outsource accounting to cut costs, gain financial expertise, scale efficiently, and reduce risk without hiring full-time staff.

Key reasons companies outsource accounting:

- Cost Efficiency:

Replacing salaried roles with a flexible provider eliminates expenses tied to benefits, payroll taxes, training, and overhead. Most outsourcing agreements are governed by a clear Statement of Work (SOW) and cost-effective SLA-backed pricing models. - On-Demand Expertise:

Instead of hiring a full-time CFO, businesses can access high-level strategic insight (e.g., margin analysis, forecasting) as needed. The same applies to controller-level reviews and compliance support. - Scalability:

As businesses grow, especially those using platforms like Stripe or Shopify, transaction volume, reporting complexity, and reconciliation requirements increase. Outsourced accounting teams scale service without process breakdowns. - Process Maturity:

Providers bring structured workflows, automation, and documentation, including close checklists, policy controls, and audit trails, which ensure repeatable, accurate month-end cycles across tools like QuickBooks or Xero. - Risk Reduction:

Independent reviews, dual-control reconciliations, and managed access to financial systems protect against internal fraud, misstatements, and audit gaps. - Owner Focus:

Founders and ops leaders stay focused on growth, product, and customer experience while experienced accountants handle financial clarity and control behind the scenes.

What Accounting Tasks can a Small Business Outsource?

Small businesses can outsource everything from basic bookkeeping to CFO-level strategy, scaling finance without full-time hires.

Bookkeeping (high-frequency fundamentals)

- Categorize daily transactions across all accounts.

- Reconcile bank and credit card activity monthly.

- Capture receipts and store them with proper documentation.

- Apply recurring entries and automated rules for efficiency.

- Generate basic monthly financial reports via QuickBooks or Xero.

Tools: QuickBooks Online, Xero, Dext, Hubdoc, bank feeds, audit trail

Accounts Payable (AP)

- Enter and code vendor bills accurately.

- Set up approval workflows with role-based access controls.

- Manage vendor payments and recurring payment runs.

- Enforce expense policies and spending thresholds.

Tools: Bill.com, Melio, RBAC workflows

Accounts Receivable (AR)

- Configure invoicing and manage recurring billing schedules.

- Build workflows for timely payment collection and reminders.

- Match payments to deposits and reconcile discrepancies.

- Monitor aging receivables and optimize DSO.

Tools: Stripe, PayPal, Square, QuickBooks Payments, AR aging dashboards

Payroll Support (coordination + reconciliation)

- Support payroll processing with tools like Gusto or ADP.

- Post payroll journal entries and perform reconciliations.

- Coordinate payments to contractors and freelancers.

Tools: Gusto, ADP, Paychex, QuickBooks Payroll

Month-End Close + Controller Services

- Maintain a close calendar with strict task checklists.

- Record accruals, prepaids, and depreciation.

- Review transactions and make classification corrections.

- Deliver a full management reporting pack.

Frameworks: GAAP, IFRS; Tools: Close checklist, journal entry logs

Tax Coordination and Readiness

- Ensure bookkeeping aligns with tax filing requirements.

- Organize tax schedules and maintain audit-ready records.

- Liaise with CPAs or EAs to support filings across jurisdictions.

Entities: CPA, EA, IRS/HMRC/CRA/ATO/FBR

Fractional CFO (Strategic Finance)

- Deliver cash flow forecasting (including 13-week models).

- Lead budgeting cycles and track actuals vs forecast.

- Build KPI dashboards and analyze gross margin trends.

- Prepare lender-ready reports for funding or credit needs.

Tools: Cash runway models, budget dashboards, virtual CFO platforms

What Should you NOT Outsource (or Should you Keep Final Control Over)?

Retain control over payments, admin access, and strategic decisions to prevent risk, fraud, and misaligned financial actions.

- Keep final approval of all payments and bank transactions under the direct control of the business owner or controller; never delegate fund disbursement blindly.

- Avoid granting unrestricted admin access to accounting systems; enforce multi-factor authentication (MFA), least privilege, and access logs.

- Don’t allow one vendor or individual to handle both AP and reconciliations without oversight. This breaks the segregation of duties and creates fraud risk.

- Retain all strategic decision-making related to pricing, hiring, capital allocation, or financing; outsourced teams execute, but don’t own the business context.

What are Benefits of Outsourced Accounting Services?

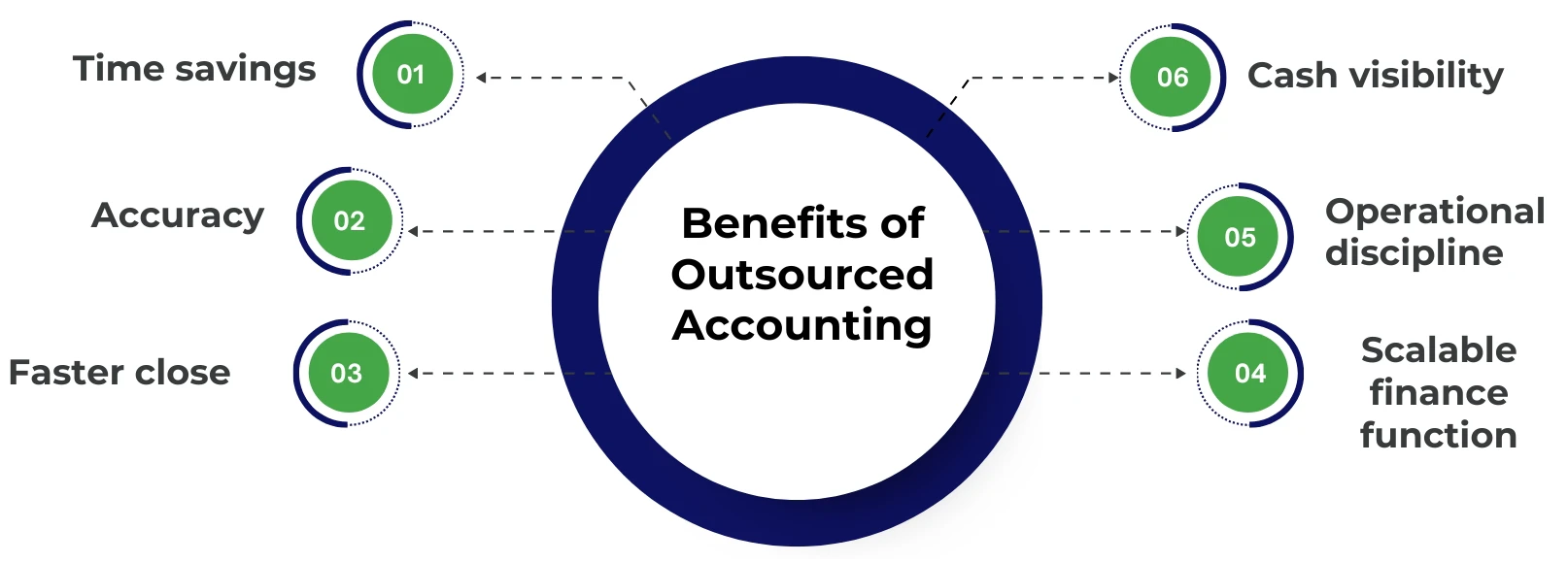

Outsourcing accounting improves accuracy, speed, visibility, and scalability, which frees leadership to focus on strategic growth.

- Time savings → 10–15 hours/week reclaimed → Business owner offloads reconciliations and report prep to focus on operations.

- Accuracy → consistent reconciliations, fewer reclasses → Monthly P&L and balance sheet reflect true financial health with minimal adjustments.

- Faster close → books finalized by day 10–15 → Enables timely reviews and confident decisions using current KPIs and cash flow data.

- Cash visibility → sharper forecast accuracy → Proactive cash management with fewer shortfalls and stronger reserve planning.

- Operational discipline → standardized AP/AR workflows → reduced DSO, improved vendor and customer payment behavior, and fewer late fees.

- Scalable finance function → layer in controller or CFO support → Seamlessly expand capabilities as the business grows in size and complexity.

Risks of Outsourced Accounting (and How to Prevent Them)

Outsourcing carries quality, billing, lock-in, and security risks, but each is preventable with the right controls, oversight, and documentation.

Quality Risks

- Misclassified entries, incomplete reconciliations, or poor reporting degrade financial accuracy.

- Bookkeeping-only vendors often overstep into controller-level decisions without the required rigor.

- Prevention: Use a close checklist, maintain a clean chart of accounts, and ensure a structured review process by qualified personnel.

Scope and Billing Risks

- Scope creep and vague deliverables can lead to surprise fees, especially during catch-up or cleanup phases.

- Prevention: Define a clear Statement of Work (SOW), use SLAs, and formalize all scope changes through documented change orders.

Vendor Lock-In Risks

- Lack of documentation and poor handover processes trap businesses with one provider.

- Prevention: Insist on standardized SOPs, full documentation of workflows, and a clear offboarding clause outlining file ownership.

Security and Data Risks

- Shared logins, excessive permissions, and unsecured file sharing expose sensitive financial data.

- Prevention: Enforce MFA, RBAC (role-based access control), least-privilege permissions, audit logs, and secure file sharing via vetted platforms.

Mitigation Checklist

- Run a quarterly access review and maintain an approvals workflow.

- Stick to a defined close calendar and require monthly financial reviews with documented outcomes.

These controls collectively reduce operational risk and improve accountability.

Outsourcing Accounting Cost for Small Business (Pricing + What Affects it)

Outsourcing costs vary by volume, complexity, and scope. Most firms charge by retainer, hourly, or transaction-based models.

Typical Pricing Models

- Monthly retainer: Fixed recurring fee based on business size, transaction volume, and service level.

- Hourly billing: Applied to one-time cleanups, system migrations, or special projects outside the standard scope.

- Per-transaction pricing: Scales with the number of transactions processed; common for e-commerce and high-volume businesses.

- Add-ons: Extra charges for payroll, tax filings, VAT compliance, or CFO advisory are layered onto the core services.

Entities to expect pricing quotes: Retainer agreements, hourly rates, add-on services, defined project scopes.

What Drives Cost (The Levers)

- Transaction count per month: More entries = more processing time and review.

- Bank and payment platforms: Each additional account (Stripe, PayPal, Wise, etc.) adds reconciliation complexity.

- AP/AR volume: High invoice or bill volume requires more oversight and workflow management.

- Payroll size: More employees and contractors drive up processing and reconciliation needs.

- Inventory or e-commerce complexity: Systems like Shopify, Amazon, and Cin7/DEAR add layers of SKU tracking and COGS allocation.

- Multi-entity or currency support: Increases compliance requirements, reporting formats, and system configurations.

- Backlog or catch-up work: Outdated books increase short-term cost due to manual cleanups and restatements.

How to Reduce Outsourcing Cost (without increasing risk)

You can lower outsourced accounting costs by streamlining workflows, enforcing controls, and avoiding scope creep, without sacrificing quality.

- Standardize document intake: Use clear naming conventions and enforce deadlines for all receipts and invoices.

- Maintain a clean chart of accounts: Avoid frequent reclassifications that increase review time and errors.

- Batch AP processing: Group payment runs and apply approval thresholds to reduce manual touchpoints.

- Consolidate tools: Eliminate redundant software and ensure integrations feed a single source of truth.

- Automate transactions: Leverage QuickBooks or Xero bank rules to auto-categorize recurring entries.

- Isolate catch-up work: Separate one-time cleanups from your monthly scope to control budget and timing.

- Schedule monthly reviews: Regular check-ins prevent rework, misalignment, and overlooked issues.

- Restrict admin access: Limit system control and avoid off-scope ad hoc requests that inflate billing.

Tools & frameworks to use: Chart of accounts management, Bill.com/Melio approval workflows, SOPs, QuickBooks/Xero automation rules.

Outsourced vs In-House vs DIY (Which is Best for you?)

The best fit depends on size and complexity. DIY suits early-stage, in-house works for scale, and outsourcing offers expert flexibility.

DIY (Software + Light Support)

- Best for: Early-stage or micro-businesses with minimal transactions.

- Risks: Inconsistent records, missed deductions, and surprise tax liabilities due to a lack of oversight.

- Tools: QuickBooks, Xero, Wave, manual spreadsheets, self-managed workflows.

In-House Hire

- Best for: Businesses with high transaction volume and operational complexity needing daily oversight.

- Hidden Costs: Recruiting, onboarding, training, payroll taxes, turnover risk, and management overhead.

- Roles involved: Bookkeeper, staff accountant, or full-time controller, depending on scale.

Outsourced Team (Bookkeeping + Controller + CFO)

- Best for: Growing businesses seeking high-quality finance operations without full-time costs.

- Model: Client Accounting Services (CAS) offering tiered expertise, from reconciliations to strategic finance.

- Benefits: Scalable support, reduced cost structure, and specialized oversight via fractional CFOs and controllers.

How to Choose the Right Outsourced Accounting Provider

Choose the right outsourced accounting provider based on team structure, credentials, industry fit, tech compatibility, and strong security practices.

Provider Types

- Freelance bookkeeper: Cost-effective but may lack oversight, scalability, or controls.

- Boutique accounting firm: Offers personalized service but may have limited capacity or range.

- CAS team model: Combines bookkeeper, reviewer, and controller under one structure for built-in checks and strategic depth.

- Offshore + local review: Hybrid approach that blends cost savings with local compliance and review assurance.

Credentials and Specialization

- Look for providers with industry-specific experience, e.g., SaaS, ecommerce, agencies, or construction.

- Ensure work is reviewed by a qualified CPA, EA, or controller, not just junior staff.

- Validate alignment with your tools: Stripe, Shopify, POS systems, etc.

- Certifications to look for: CPA (U.S.), ACCA/CIMA/CA (global)

Tech Stack Compatibility

- Core accounting: QuickBooks Online, Xero

- AP/AR management: Bill.com, Melio

- Payroll systems: Gusto, ADP, Paychex

- Sales tax compliance: Avalara, TaxJar (for ecommerce or multi-state businesses)

Security and Controls Due Diligence

- Verify use of RBAC (role-based access control), MFA, audit logs, and encrypted file sharing.

- Ask for documented controls or assurance reports (SOC 1, SOC 2, SSAE 18, ISAE 3402).

- Avoid providers who cannot demonstrate secure data handling.

Provider Interview Questions

- “What exactly is included in a month-end close?”

- “Who reviews reconciliations and journal entries?”

- “How do you reconcile Stripe/PayPal/Square payouts?”

- “How do you handle scope changes (change orders)?”

- “What’s your response SLA and communication channel (Slack/email/monthly call)?”

- “What’s your offboarding process and file ownership policy?”

A structured vetting process ensures you select a provider that’s secure, specialized, and aligned with your business needs.

How Outsourcing Accounting Works (Step-by-Step)

Outsourced accounting follows a phased process: onboarding, cleanup, and ongoing monthly cycles aligned with your financial goals.

Step 1: Onboarding Checklist (Days 1–14)

- Grant secure access and permissions with MFA and least-privilege principles.

- Set up document storage using platforms like Google Drive, Dropbox, or SharePoint.

- Connect key systems, e.g., Stripe, Gusto, QuickBooks.

- Provide initial data including, prior statements, entity structure, and expense policies.

Step 2: Cleanup & Setup (Weeks 3–6)

- Reconcile previous months to baseline accuracy.

- Clean and restructure the chart of accounts.

- Establish or revise accounting policies and SOPs for consistency.

- Configure automation rules and approval workflows where needed.

Step 3: Ongoing Operations (Monthly Rhythm)

- Follow a structured close calendar to complete reconciliations, journal entries, and accruals.

- Deliver a full reporting pack including P&L, balance sheet, and cash flow statements.

- Review budget vs actuals and key performance indicators (KPI dashboard).

- Conduct a monthly finance meeting to align on metrics, variances, and next steps.

A consistent workflow ensures financial clarity and proactive insights as part of your operational rhythm.

What are Security, Privacy, and Compliance Basics?

Protecting sensitive financial data requires access controls, encryption, compliance frameworks, and documented governance policies.

What Sensitive Data Is Involved

- Bank account details, payroll records, tax IDs, and customer payment information.

- Data from platforms like Stripe, Gusto, and accounting systems is subject to strict confidentiality and access controls.

How to Protect It

- MFA (Multi-Factor Authentication): Enforces secure logins across platforms.

- RBAC (Role-Based Access Control): Limits system access based on role to enforce the principle of least privilege.

- Audit Logs: Track every system action and data access event.

- Secure File Sharing: Use encrypted platforms like Google Drive, Dropbox, or SharePoint with restricted permissions.

- Breach Protocols: Ensure your provider has a documented breach notification process in case of compromise.

Compliance Basics

- Retain financial records per jurisdictional mandates, typically 5 to 7 years.

- Use NDAs and Data Processing Agreements (DPA) with all providers handling sensitive data.

- Maintain audit readiness with clear documentation, version control, and process evidence.

Optional Compliance Frameworks:

- NIST CSF (Cybersecurity Framework)

- ISO 27001 (Information Security)

- GDPR / CCPA / CPRA (for privacy regulation in applicable regions)

Security is not optional; it’s foundational. Ensure every outsourced partner meets your data governance standards.

Industry-Specific Outsourcing Tips

Tailor your outsourced accounting setup to industry-specific workflows; each sector has unique reporting, compliance, and process needs.

E-commerce

- Track inventory and cost of goods sold (COGS) accurately across platforms.

- Reconcile multi-channel payouts from Shopify, Amazon, Stripe, and PayPal.

- Automate sales tax compliance using Avalara or TaxJar.

- Monitor chargebacks, refunds, and order-level profitability.

Tools: Shopify, Amazon, Stripe, PayPal, Avalara, TaxJar, Cin7, DEAR

Agencies and Services

- Use job costing to measure profitability by project or client.

- Integrate time tracking for billable hours and resource allocation.

- Coordinate complex contractor workflows and 1099 payments.

Tools: Harvest, Toggl, HubSpot, custom job costing systems

SaaS

- Manage subscription billing cycles and recurring revenue.

- Track MRR/ARR, churn, and customer lifetime value.

- Apply proper revenue recognition for deferred revenue.

Tools: Stripe Billing, Chargebee, SaaS metrics dashboards

Construction

- Apply detailed job costing for labor, materials, and subcontractors.

- Use progress billing to invoice based on work completed.

- Track retainage balances and release timelines per contract.

Needs: Contractor payments, job phase tracking, lien compliance

Frequently Asked Questions (FAQs)

Conclusion + Next steps

Outsourcing your accounting can transform your finance function if approached with clarity and control. Here’s a simple, strategic path forward:

- Define what to outsource: Identify the tasks (bookkeeping, AP/AR, payroll, CFO advisory) and expected deliverables like reconciled books, monthly reports, or cash forecasts.

- Shortlist and vet providers: Evaluate fit based on tech stack, service model, industry specialization, and documented controls. Use a vetting checklist that includes SOW, SLA, security protocols, and compliance readiness.

- Run a 30-day pilot: Test the provider’s capabilities by measuring month-end close speed, report accuracy, and visibility into KPIs and cash position. Review the close calendar and reporting pack to validate outcomes.

With the right approach, outsourced accounting can scale with your business while delivering control, clarity, and cost efficiency.