U.S. businesses are reassessing how they manage increasingly complex tax responsibilities amid significant IRS workforce reductions. The agency is facing deep staffing cuts, with plans to eliminate up to 25% of its workforce and even larger reductions possible in some departments.1 As a result, taxpayers are experiencing longer wait times, diminished support, and increased delays in tax processing and refunds during the critical filing season. This environment is making it more challenging for businesses to receive timely assistance and navigate their tax obligations effectively.

At the same time, the broader tax and regulatory environment continues to evolve, introducing uncertainty into planning and compliance efforts. These shifting standards are prompting businesses to reevaluate their tax positions and strengthen internal controls to remain aligned with current expectations.

In this environment of heightened complexity and reduced institutional support, many organizations are turning to tax preparation outsourcing. By leveraging external expertise, businesses can navigate the evolving tax code more effectively and ensure compliance without the added stress of managing intricate tax matters internally.

Key Takeaways

- 1With up to 25% of IRS staff facing layoffs, businesses are experiencing slower responses and more compliance risk.

- 2Expiring TCJA provisions—like standard deduction reductions and estate tax shifts—require updated tax strategies.

- 3Businesses can cut operational costs by up to 60% through outsourced tax preparation and accounting services.

- 4Organizations report 20–30% productivity gains by outsourcing during peak tax seasons.

- 5From precise bookkeeping to U.S. tax return preparation, Premier helps businesses streamline compliance with secure, cost-efficient delivery.

Breaking Down the Tax Preparation Outsourcing Model

Tax preparation outsourcing has evolved into a strategic operational model for businesses seeking more accuracy, efficiency, and control over their financial compliance. Rather than being treated as one-off, tax responsibilities are now managed through streamlined, structured processes by specialized external teams.

Strategic Implications for Businesses

The continually evolving regulatory and legal landscape introduces new layers of complexity for businesses, ranging from intricate deductions to dynamic reporting requirements. For organizations operating across jurisdictions or managing legacy financial systems, these demands elevate the need for accuracy, compliance, and agility.

As a result, many companies are reevaluating their internal capabilities and adopting outsourced tax preparation and accounting models to remain responsive, compliant, and operationally efficient—especially during high-volume periods like tax season.

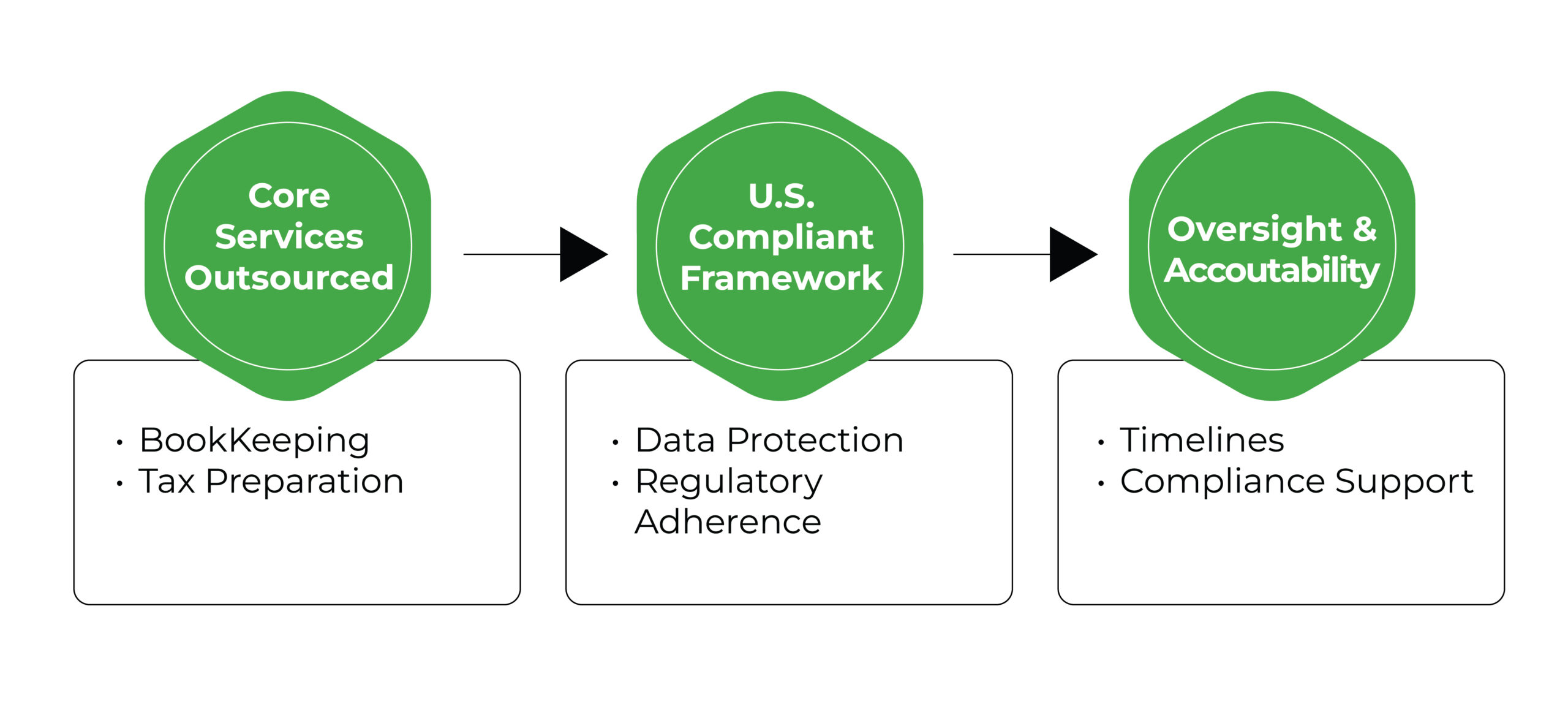

Here’s what this model typically includes:

1) Core Services Outsourced

- Bookkeeping: Ongoing recording of all financial transactions—including sales, purchases, and expenses—to maintain an accurate, up-to-date financial view.

- Tax Preparation: Leveraging well-maintained records to prepare and file income tax returns, ensuring proper reporting based on actual business performance.

2) U.S. Compliant, Secure Framework

Outsourced tax partners typically have expertise in U.S. tax laws and maintain strict compliance standards. Secure data environments and process controls protect financial data and reduce audit risk.

3) Dedicated Oversight and Accountability

Effective tax outsourcing models include strong account management to oversee timelines, address compliance complexities, and maintain clear communication across every stage of the tax cycle.

This model enables organizations to reallocate internal finance resources to more strategic initiatives while ensuring that tax reporting remains timely, accurate, and audit-ready year-round.

The Executive Case for Tax Preparation Outsourcing

Many executives are examining their tax operations more closely, aiming to optimize them for the future. The complexity of modern tax regulations, increased IRS scrutiny, and the rising cost of internal tax departments are compelling leaders to consider tax outsourcing as a strategic lever.

Operational Efficiency and Streamlined Processes

Outsourcing tax preparation helps internal teams reduce the burden of handling complex, time-consuming tax tasks. By transferring these responsibilities to experts, companies can streamline workflows and improve overall productivity within their finance department.

Cost Optimization

Maintaining an internal tax department can be expensive, requiring ongoing investments in staffing, training, and software tools. Tax outsourcing provides a cost-effective solution, allowing companies to scale services based on demand without the financial overhead of permanent hires.

Access to Specialized Expertise

Staying compliant can be challenging as tax laws become more intricate and global regulations evolve. Outsourced tax preparation offers access to specialists with up-to-date knowledge on domestic and international tax codes, reducing the risk of non-compliance.

Scalability and Flexibility

Tax needs fluctuate, especially during peak tax seasons. Outsourcing tax functions provides the scalability to increase or decrease resources based on demand, without the challenges of hiring, training, or downsizing in-house staff. This flexibility is particularly important for companies that experience seasonal changes in workload.

Premier NX – The Right Partner for Tax Preparation Outsourcing

U.S. Tax Support and Preparation Readiness

With transaction-level accuracy and compliant recordkeeping, Premier NX supports the preparation of U.S. income tax returns by ensuring clients’ financial data is clean, organized, and ready for submission. This minimizes risk and facilitates smooth coordination with filing authorities or certified tax professionals.

Bookkeeping and Transaction Management

Premier records and reconciles all financial transactions—sales, purchases, expenses—to support reliable reporting and informed financial decisions.

Financial Oversight and Secure Handling

Dedicated account management ensures timelines are met and data is handled securely. Premier’s structured processes enable consistent communication and end-to-end visibility throughout the tax cycle.

Cost-Efficient, Scalable Delivery

Premier provides a compliant outsourcing model that reduces the need for costly in-house tax resources, supporting flexibility, scalability, and measurable cost savings.

Streamline Tax Season with Outcome-Driven Financial Operations

In today’s tax environment, accuracy, compliance, and cost-efficiency are strategic imperatives. With Premier’s tailored tax preparation outsourcing solutions, you gain a scalable, secure framework built to support complex U.S. tax obligations without overburdening your internal teams.

Our FinOps pillar delivers structured bookkeeping, expert tax filing support, and proactive account management, ensuring your financial operations are audit-ready, responsive, and future-aligned.

Connect with Premier’s finance experts for a no-obligation consultation—explore how our tailored support can simplify your tax cycle and strengthen your financial operations, risk-free.