Small businesses face financial blind spots that limit growth. CFO services provide strategic clarity, enabling better decisions and long-term success.

Small business owners often juggle financial responsibilities without the full picture. Limited oversight into cash flow, rising expenses, and uneven revenue cycles can hinder profitability and stall growth. These financial challenges are rarely due to poor ideas but rather a lack of structured financial management.

That’s where CFO services come in. CFOs act as financial architects who bring structure, oversight, and forward-looking insight to your finance department.

This blog will explore what CFO services for small businesses entail, the types available, what they do, and why they’ve become indispensable for owners looking to scale with confidence.

What Are CFO Services for Small Businesses?

CFO services provide financial leadership for small businesses, focusing on strategy, oversight, and growth.

- Who is a CFO: A Chief Financial Officer (CFO) provides financial leadership, ensuring that a company’s financial operations align with its business strategy.

- CFO Services for Small Businesses: For small businesses, CFO services mean gaining access to executive-level financial expertise without hiring a full-time executive.

- Key Difference: Accountant vs CFO: While Certified Public Accountants (CPAs) and controllers focus on compliance, tax filing, and historical data, CFOs look ahead. Their role is to turn financial data into actionable insights that drive business finance decisions, ensure governance, and support sustainable growth.

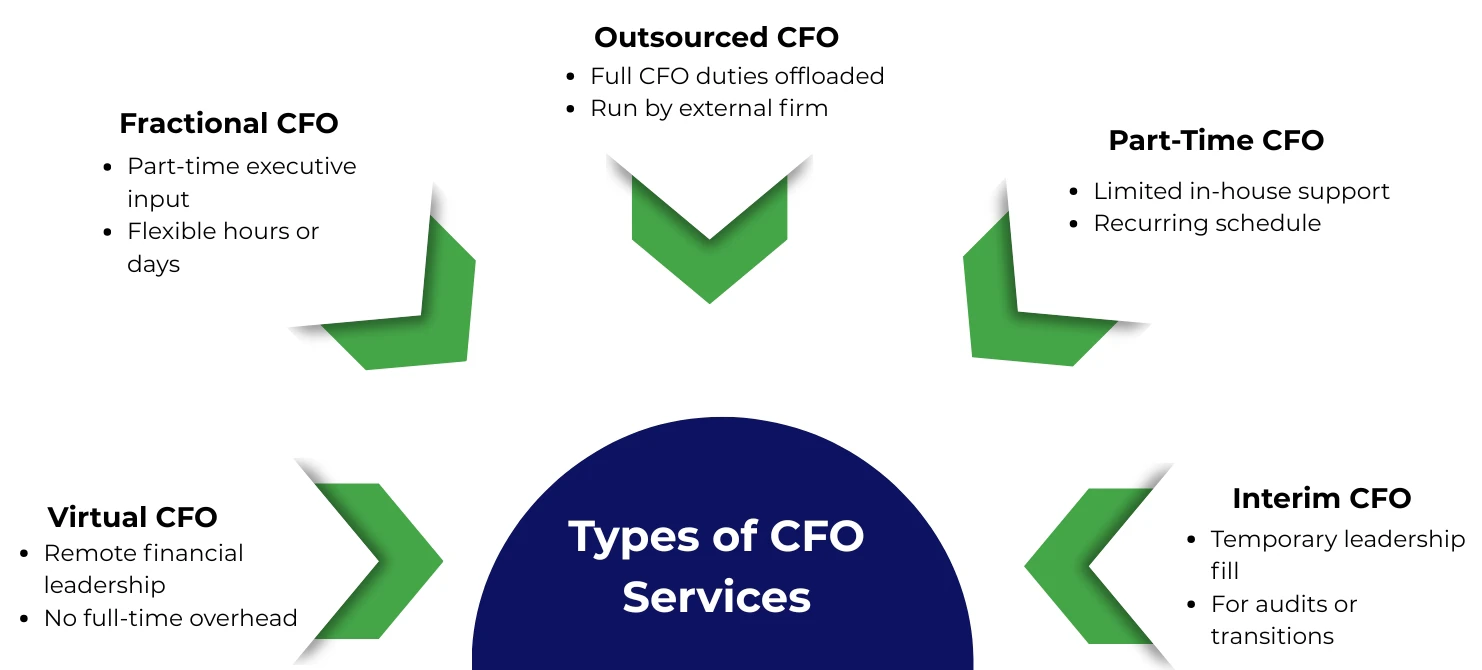

What are the Types of CFO Services?

CFO services come in flexible formats that offer small businesses access to tailored financial expertise based on their size, stage, and specific needs.

Virtual CFO

A Virtual CFO provides remote financial leadership without being on-site. Ideal for small businesses that need ongoing strategic support without full-time overhead.

Fractional CFO

A Fractional CFO works with your business for a set number of hours or days per month. Best for SMEs that need executive insights but don’t require full-time input.

Outsourced CFO

An Outsourced CFO is a third-party financial consultant or firm managing all CFO duties. Useful for businesses seeking complete financial oversight through professional services.

Part-Time CFO

A Part-Time CFO joins your team in a limited, recurring capacity. This model suits growing businesses that need regular financial guidance without hiring internally.

Interim CFO

An Interim CFO fills a temporary gap during leadership transitions or urgent needs. Often used during mergers, audits, or while hiring a permanent CFO.

What Do CFO Services Actually Do?

CFO services help small businesses optimize their finances through planning, reporting, analysis, and risk management to support data-driven decision-making.

- Financial strategy and planning to guide long-term business direction with expert financial leadership

- Budgeting and forecasting that aligns expenses and revenue with growth targets and market conditions

- Profitability improvement by analyzing financial statements and reducing operational inefficiencies

- Cash flow management to monitor inflows, control outflows, and maintain financial stability

- Risk management through scenario modeling, compliance tracking, and governance practices

- Financial reporting and dashboards that visualize metrics across income statements and balance sheets

- KPI tracking for performance monitoring tied to business goals and financial health

- Investor and funding readiness, including audit support, financial modeling, and capital planning

- Financial analysis to interpret data trends from cash flow statements and operational metrics

- Strategic financial oversight to connect business planning with measurable financial outcomes

Benefits of CFO Services for Small Businesses

CFO services drive financial clarity, efficiency, and growth that help small businesses scale strategically while minimizing risk and maximizing ROI.

- Improved Profitability: CFOs analyze financial performance across income streams and cost centers to identify inefficiencies and drive profit-focused adjustments. Their strategic oversight leads to better margin control, targeted cost reduction, and higher ROI across the business.

- Better Decision-Making: With accurate financial reporting and forecasting, business owners gain the confidence to make high-impact decisions. CFO services translate complex financial data into actionable insights that support smarter, faster strategic choices.

- Financial Clarity: CFOs bring structure to fragmented financial operations. Through detailed financial statements, dashboards, and KPI tracking, they create transparency that helps leadership teams understand true business performance.

- Stronger Cash Flow: Maintaining healthy cash flow is critical for small business survival. CFOs implement cash flow forecasting, optimize payment cycles, and manage liquidity to ensure operational continuity and prevent shortfalls.

- Reduced Financial Risk: By applying governance controls, audit readiness, and compliance tracking, CFO services reduce exposure to financial missteps. They help navigate tax regulations, market volatility, and operational risks with precision.

- Efficient Scaling: Scaling without financial planning leads to burnout and inefficiency. CFOs guide growth with sustainable financial models, investment planning, and resource allocation aligned to long-term goals.

- Long-Term Stability: A CFO’s role is to create resilience. Their forward-looking strategies stabilize business operations, ensuring consistent performance and adaptability in changing markets.

- Operational Efficiency: CFOs streamline financial operations by automating reporting processes, optimizing workflows, and aligning finance with core business functions to reduce friction and boost productivity.

- Competitive Advantage: Access to high-level financial insight allows small businesses to compete strategically. CFO services provide the intelligence needed to move faster than competitors and adapt to market shifts with agility.

Who Should Consider CFO Services?

CFO services are ideal for growth-stage businesses facing complexity, risk, or strategic decisions that go beyond basic accounting.

- Startups or SMEs with growing revenue but inconsistent profitability

- Entrepreneurs who need expert guidance on financial risk and planning

- Family-owned businesses lacking internal financial leadership

- Scaling businesses preparing to expand operations or headcount

- Companies struggling with cash flow and liquidity management

- Firms with multi-location or multi-revenue streams requiring consolidated oversight

- Businesses planning to raise funding or attract investors

- Organizations needing strategic clarity on budgeting, forecasting, and investment

- Growth-stage companies aiming for long-term financial stability

How CFO Services Work: Step-by-Step

CFO services follow a structured process that begins with assessment and ends with continuous optimization through data, reporting, and strategic oversight.

Step 1: Business Assessment

The CFO begins with a deep dive into the company’s financial health. This includes reviewing financial statements, understanding business goals, and identifying gaps in financial operations or systems.

Step 2: Financial Cleanup & Data Review

Legacy records, inconsistent bookkeeping, and outdated systems are corrected. This may involve cleaning up accounting software like QuickBooks or Xero, and aligning data formats, and reconciling discrepancies.

Step 3: Strategy Development

Using insights from the audit, the CFO builds a tailored financial strategy. This includes budgeting, forecasting, risk mitigation, and aligning finance with the company’s long-term objectives.

Step 4: Implementation & Oversight

Strategic plans are executed with the CFO overseeing financial systems, managing processes, and integrating tools such as automation platforms or cloud-based dashboards for real-time visibility.

Step 5: Reporting & Optimization

The CFO delivers consistent financial reporting through dashboards and performance metrics. Data is used to refine the strategy, track KPIs, and adapt to business changes for sustained growth.

Cost of CFO Services

CFO services vary by engagement type, with flexible retainer, hourly, or monthly models that are generally lower operating costs than a full‑time CFO while still delivering strategic ROI.

Fractional CFO Cost Range:

A fractional CFO typically works parttime with a predictable retainer or hourly rate based on scope and business size. This model offers senior strategic support at a fraction of fulltime CFO payroll.

Virtual CFO Monthly Range:

Virtual CFO services are charged as a monthly fee covering ongoing financial leadership, reporting, and advisory. Costs adjust with the level of involvement and complexity of financial operations.

Outsourced CFO Range:

Outsourced CFOs, often part of a professional services firm, operate under a blended retainer or project fee. This structure may include financial systems setup, reporting process management, and dashboard support as needed.

Fulltime CFO Salary Comparison:

A full‑time CFO’s salary and payroll costs are significantly higher due to benefits, taxes, and long‑term employment expenses. These costs are part of operating costs and a major consideration for smaller businesses.

Why CFO Services Cost Less Than Hiring:

Outsourcing or engaging a fractional or virtual CFO reduces payroll and budget allocation pressure. Small businesses avoid fulltime CFO salary and benefits while gaining strategic financial guidance and better ROI on their financial investment.

Real-World Case Study: CFO Services in Action

The Challenge

One of our clients in the healthcare industry was struggling with a growing backlog in key financial processes. With internal teams overwhelmed, critical tasks like invoicing, reconciliation, and payroll were delayed, which created reporting gaps, compliance risks, and operational inefficiencies.

The Solution: Strategic Financial Support

Premier NX deployed a dedicated financial operations team to handle bookkeeping, reconcile records, manage invoice processing, and support payroll. The focus was on restoring accuracy, implementing controls, and ensuring continuity without expanding internal headcount or overloading core staff.

The Results

- Cleared all accounting and reconciliation backlogs

- Restored on-time invoicing and payroll processing

- Improved financial reporting accuracy and timeliness

- Reduced compliance risk and operational delays

How to Choose the Right CFO Service Provider

Selecting a CFO partner requires vetting their expertise, tools, communication, and transparency to ensure they align with your financial goals and compliance needs.

- Proven Experience: Look for a provider with executive-level financial expertise, including experience with SMEs, startups, or scaling companies.

- Industry Knowledge: Deep understanding of your industry ensures relevant forecasting, budgeting, and compliance support.

- High-Quality Reporting: Assess their ability to deliver timely, accurate, and visually clear financial reporting and dashboards.

- Clear Communication Style: Your CFO partner should offer consistent updates, strategic input, and responsiveness tailored to your leadership team.

- Modern Financial Tools: Check their use of cloud accounting software, financial automation tools, and data security protocols.

- Transparency and Governance: Ensure clarity around pricing models, deliverables, timelines, and compliance with financial governance standards.

- Strong Client Track Record: Seek testimonials, case studies, and a demonstrable history of improving financial control and ROI for similar clients.

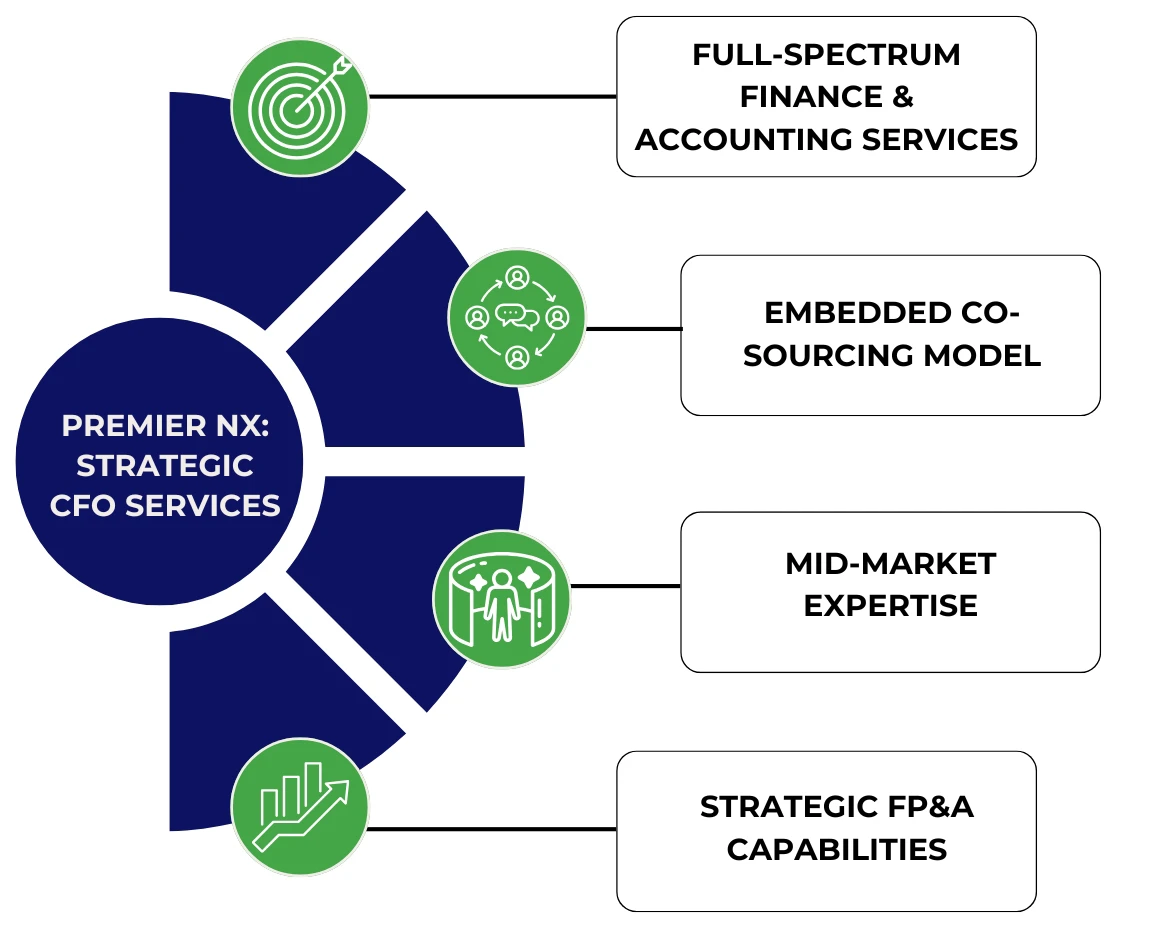

Premier NX: Strategic CFO Services, Purpose-Built for the Mid-Market

Premier NX delivers expert-level finance and accounting outsourcing with strategic depth, flexible engagement, and forward-looking financial capabilities.

Full-Spectrum Finance & Accounting Services:

We manage end-to-end finance operations, from bookkeeping, payroll, and reconciliations to cash flow management and monthly closes—with the accuracy and control mid-market companies need to scale.

Embedded Co-Sourcing Model:

Our teams operate as an extension of your internal staff, aligning with your systems, processes, and goals while delivering measurable outcomes, not just offloaded tasks.

Mid-Market Expertise:

With deep experience supporting businesses in the “Muddy Middle,” we specialize in helping 100–1000 employee organizations navigate complex financial operations on leaner budgets.

Strategic FP&A Capabilities:

Beyond tactical execution, we bring CFO-level insight with financial planning, forecasting, and analysis that support faster business decisions.