Redefining Finance Operations in a Dynamic Era

In an era shaped by rapid technological advancements and global interconnectedness, Finance and Accounting (F&A) business process outsourcing has become a cornerstone of strategic growth and operational resilience for businesses. No longer limited to cost reduction, F&A outsourcing is now a driving force for innovation, empowering companies to leverage advanced technologies, address critical talent shortages, and navigate increasingly complex financial ecosystems.

Key Takeaways

- 1Predictive Analytics – 90% of businesses use it to forecast trends. Are you leveraging data?

- 2Smart F&A – Automation + Human Insight = Agility

- 3ESG is Essential – Sustainability is now a financial priority.

- 4Cybersecurity: Risk or Opportunity? – With rising cyber threats, secure F&A outsourcing is a necessity.

- 5Premier NX: Your F&A Outsourcing Partner – We blend AI and human insight to drive business success.

As we look ahead to 2025, Finance and Account (F&A) outsourcing stands at the intersection of technology and human expertise, enabling organizations to achieve unparalleled efficiency and agility. F&A outsourcing transforms financial operations into a dynamic engine of strategic decision-making and value creation by blending cutting-edge analytics, intelligent automation, and human ingenuity. This blog explores the evolving F&A outsourcing landscape, highlighting key trends, challenges, and abundant opportunities to thrive in a competitive market.

The Transformative Power of Tech-Enabled Outsourcing

Outsourced financial services leverage cutting-edge tools and strategies to enable businesses to focus on their core objectives. Key applications include:

Predictive Analytics for Proactive Decision-Making

F&A outsourcing providers empower organizations to forecast trends, identify risks, and optimize strategies by analyzing historical and real-time financial data. Predictive analytics, augmented by human expertise, helps companies anticipate market changes with greater precision, enabling them to remain agile and competitive.

Automation and Artificial Intelligence (AI)

While automation plays a crucial role in streamlining Finance and Accounting (F&A) business process outsourcing, it is not a standalone solution. Human intervention addresses the nuances machines cannot interpret, ensures strategic insights, and maintains accountability. AI, complemented by human understanding, enhances efficiency through real-time insights and informed scenario planning. From tax planning to compliance checks, AI tools streamline operations, reduce human error, and unlock strategic opportunities. This balance of automation and human oversight safeguards against the risks of over-reliance on technology while amplifying its benefits.

Real-Time Financial Reporting

Cloud-based platforms ensure access to accurate and timely financial data, allowing businesses to make informed decisions quickly. Outsourcing firms equipped with advanced technology facilitate instant updates and analytics, fostering agility in financial management.

ESG Reporting and Compliance

Environmental, Social, and Governance (ESG) considerations are now integral to finance and accounting operations. F&A outsourcing providers assist businesses in meeting these growing requirements by integrating ESG factors into their financial reporting and strategic planning.

Enhanced Data Analytics

Outsourcing firms increasingly offer advanced analytics tools powered by AI and machine learning. These tools provide actionable insights, allowing organizations to make informed decisions based on real-time data patterns and trends.

Trends and Opportunities in Finance and Accounting (F&A) Business Process Outsourcing in 2025

As F&A evolves, several trends are defining the industry’s trajectory:

Integration of Advanced Technologies

Technologies such as AI and cloud computing are revolutionizing financial operations. AI delivers the accuracy and context needed for effective forecasting and decision-making when combined with human insight.

Emphasis on Data Security

As cyber threats escalate, F&A outsourcing should prioritize advanced cybersecurity measures. Multi-factor authentication, encryption, and regular audits protect sensitive financial data, building trust and mitigating risks.

Specialized Niche Services

From cash flow forecasting to tax planning, F&A outsourcing providers offer tailored solutions that cater to the unique needs of industries like healthcare, retail, and technology. This specialization unlocks business opportunities to optimize operations and scale efficiently, enhancing service quality and compliance.

Sustainability and ESG Prioritization

With businesses under increasing pressure to demonstrate sustainability, F&A outsourcing providers are integrating green practices into their operations. Digital transformation and eco-friendly workflows reduce environmental impact while meeting corporate social responsibility goals.

Advanced Analytics and AI Implementation

F&A outsourcing providers increasingly leverage predictive analytics and AI-driven insights to enhance financial planning and decision-making capabilities. This creates opportunities for businesses to achieve deeper market insights and improved strategic agility. When guided by human oversight, this shift empowers businesses to anticipate market shifts and manage risks more effectively.

Emphasis on Human Intervention

The growing complexity of financial operations demands a strategic balance between automation and human oversight. By emphasizing collaborative frameworks, finance and accounting outsourcing providers ensure that human expertise complements technological capabilities, delivering nuanced and precise results.

Overcoming Challenges in Finance and Accounting Outsourcing

While the benefits of F&A outsourcing are substantial, businesses must navigate potential pitfalls:

Mitigating Risks Through Human Oversight

Automation without human oversight risks oversimplifying complex financial scenarios and missing critical context. A balanced approach leverages automation for efficiency while relying on human expertise to interpret results, adapt to unforeseen events, and ensure compliance with nuanced regulations.

Navigating Regulatory Complexities

As global compliance requirements become more stringent, F&A outsourcing providers must stay ahead of regulatory changes. Businesses should partner with firms with expertise in multi-currency management, tax compliance, and ESG reporting.

Cultural and Operational Alignment

For effective collaboration, finance and accounting outsourcing providers and clients must align culturally and operationally. Clear communication, shared objectives, and adaptable processes are key to success.

Strategic Opportunities for Leveraging Tech-Enabled Finance & Accounting Solutions

To maximize the benefits of tech-enabled F&A solutions in 2025, businesses should:

Embrace Predictive Analytics

Leverage AI-driven predictive models, enhanced by human judgment, to anticipate trends and proactively address challenges. This foresight enhances decision-making and positions businesses for sustainable growth.

Invest in Technology Integration

Adopt cloud-based systems to streamline operations and enhance transparency. Collaborate with F&A outsourcing providers that prioritize innovation and scalability.

Prioritize Training and Collaboration

Equip finance teams with the skills to work alongside advanced technologies. Foster collaboration between finance, IT, and operations to align objectives and optimize outcomes.

Partner with Specialized Providers

Choose F&A outsourcing firms with expertise in your industry’s unique challenges and compliance requirements. Tailored solutions ensure better service quality and strategic alignment.

Implement Human-in-the-Loop Models

Ensure human oversight in automated processes to capture nuances, resolve complex issues, and maintain the quality of decision-making. Collaborative models between human experts and AI systems drive better outcomes.

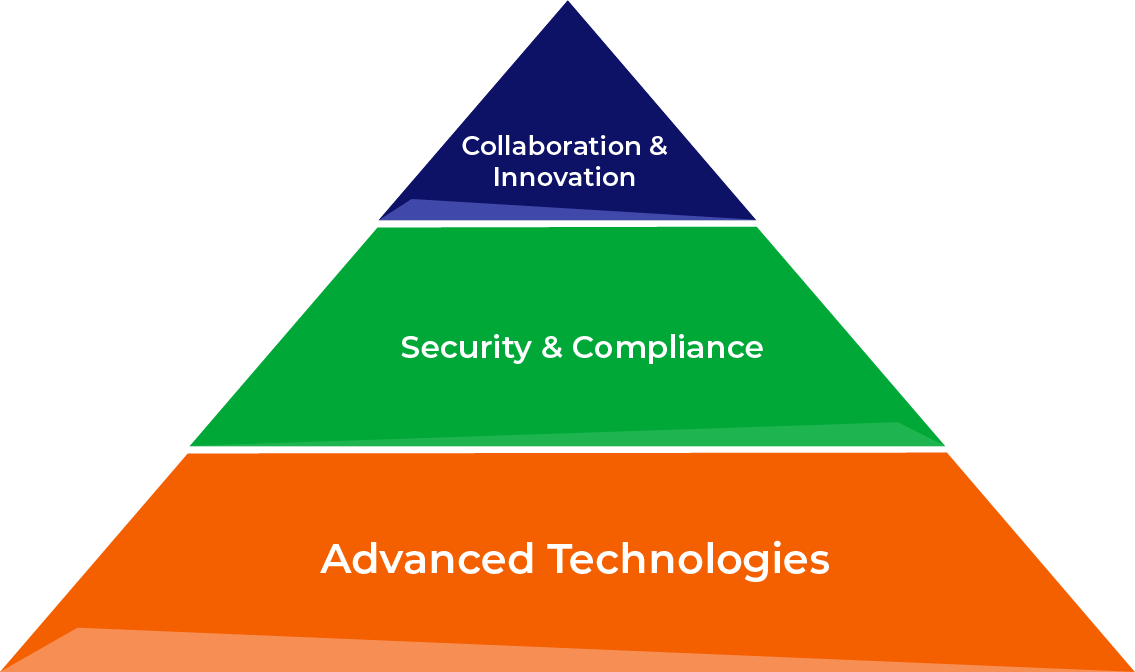

Shaping the Future of Financial Operations

Finance and Accounting (F&A) Outsourcing is at the forefront of transforming business operations in 2025. By integrating advanced technologies, prioritizing security and compliance, and fostering collaboration, F&A outsourcing providers enable businesses to navigate complexity and unlock new opportunities for growth, efficiency, and innovation. The key to success lies in leveraging these trends while addressing challenges through strategic partnerships and continuous innovation.

Are you ready to redefine your financial operations? Premier’s expertise in leveraging advanced technologies like AI and predictive analytics and a commitment to human-centric oversight empower businesses to gain a competitive edge. Let us help you turn challenges into opportunities and drive your financial operations toward strategic growth and innovation. Partner with Premier NX for tech-enabled Finance and Accounting (F&A) outsourcing solutions.